The Global Stocktake Text gives a complete package to keep the 1,5 Degrees target within sight. It introduces a goodbye to fossil fuels use and countries promise to triple renewables power capacity, double energy efficiency, and reduce methane emissions. And it also asks to accelerate work on Article 6, including the carbon market and carbon removals. How the Paris Carbon market could work? The crux of the biscuit is the ITMO. So here is about the difference between Article 6.2. and Article 6.4.

The distinct role between Article 6.2. and Article 6.4. was disputed at CoP28. The Global Stocktake asks at least to accelerate work on Art 6.

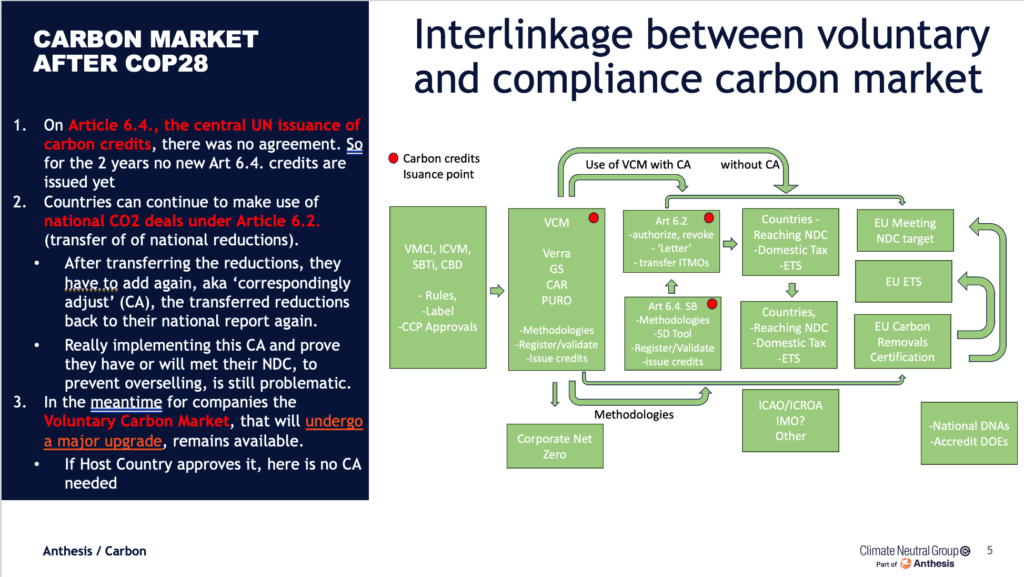

- But on Article 6.4. – the central UN issuance of carbon credits – they did not come to an agreement. So for the next years no new Art 6.4. credits will be issued

- In the meantime, for companies the Voluntary Carbon Market, that will undergo a major upgrade, remains available to use top compensate residual emissions.

- And countries can make use of national CO2 deals under Article 6.2., transfer of of national reductions, called Internationally Transferred Mitigation Outcomes (ITMOs). After transferring the reductions, the seller has to add again, a.k.a. ‘correspondingly adjustment’ (CA), the transferred reductions back to their national report again. Really implementing this CA and for countries to prove they have or will meet their NDC, to prevent overselling, is still problematic.

The Crux

The crux of the difference between Art 6.2 and 6.4 is very important. Under Art 6.2 a country can transfer ITMOs (International Transferred Mitigation Outcomes) – surplus mitigation outcomes, hence #carboncredits – if it has met its NDC target. Art 6.4. is a different mechanism: then an individual activity needs to be additional. The Supervisory Body will check that. CoP28 did not make progress on Art 6.4., but action on 6.2. deals can continue.

Under Art 6.2. a selling country need to proof additionality of reductions beyond NDC. It can do that ‘ex-post’, say by 2026. But if you want to transfer earlier, which helps early transfer of funding, the selling country needs to build trust and show progress towards its NDC. It can then also #SetAside and register early ITMO credits, if that progress towards NDC is shown. Switzerland and Thailand are preparing to actually transfer carbon credits under Art 6.2 for an EV Bus Project in Bangkok.

Swiss NGO Alliance Sud now claims this EV bus project it itself is not additional. But for Art 6.2. the only additionality needed is that Thailand meets its climate target. Switzerland can of course wish that each individual financial support is additional, according to national law, but that can never be proven, unless you use Art 6.4. So that is up to the host country. The only proof needed further Art 6.2 is that Thailand meets its NDC. But indeed this still needs proof.

On the value of Letters of #Authorization:

1) a letter to promise future authorization has not much value, hence the authorization has to be directly be followed up by actual transfer of ITMOs. And that only happens via Art 6.2 if the selling country complies with its NDC. The selling country has to prove that or build trust with his emissions reports. Only then #authorization has a meaning and value. Before that you can of course #trade but not yet actually #transfer under Art 6.2

2) authorization after transferring ITMOs should not be revocable. It is rational to have #buyersprotection and transfer means transmitting ownership because an ITMO is used for compliance. And if a buyer cancels/retires then for compliance that cannot be turned back. That is international private law.

Interesting is how the interlinkage between VCM and Art 6 activities next years will be and what the opportunities of companies are to make climate impact with the carbon market (see figure)