During the on-line climate meeting the previous 2,5 weeks there was progress, the UNFCCC Executive Secretary said during the press briefing. However, that does not seem the case on the issue of guidance on the use of carbon markets to help increase ambition in the implementation of the Paris Agreement. “Talks on carbon markets and transparency reached stalemate” writes Climate Home News. “The mindset of engagement will need to change if progress on difficult issues is to be achieved this year at Cop26,” said Tosi Mpanu Mpanu, chair of the subsidiary body on science and technology, in the closing plenary on Thursday.

Therefore, to help countries to come to a deal on the Climate Summit in Glasgow – CoP26 – in November, the British Presidency will gather 40 ministers July 23rd in London to discuss carbon market issues. These talks will be led by the ministers of Singapore and Norway, two countries that themselves also want to make use of the carbon market.

I doubt this will help ultimately countries to give clear guidance they seek. Climate talks are politically sensitive, as many interests play a role. Moreover, arguments that seem to block progress may have not much to do with a well functioning global carbon market itself. Again, the UN seems not the central place to organize a robust carbon market. Neither were countries able in the past to repair flaws of the Kyoto Protocol’s Clean Development Mechanism (CDM) and prevent the use of old CDM credits. Also, the CDM itself did not boost carbon trading; the global carbon market only flourished when the EU decided to link the EU ETS, for a limited portion, to the CDM.

Carbon market issues that need to be solved include (see also the informal note after the session):

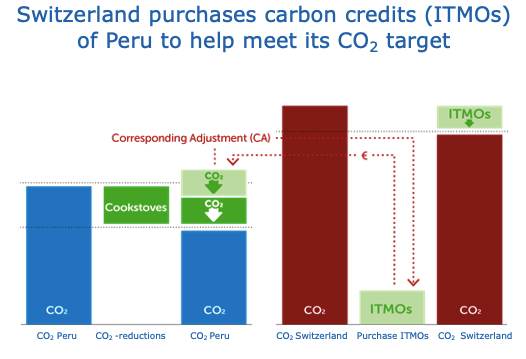

- what guidance is needed for nations that want to trade surplus emission reductions (Internationally Transferred Mitigation Outcomes, ITMOs from Article 6.2. Paris Agreement) other than transparency and double entry bookkeeping, so that is it clear reductions are counted only once and by one country to comply with an obligation? The ITMO transferring country is to ‘correspondingly adjust’ (CA) the emissions reductions from its report. See how Switzerland and Peru are preparing to meet such demands in their recent CO2 deal.

- how should a new centralized carbon credit programme ensure global reductions and learn from flaws of the CDM? (Article 6.4. of the Paris Agreement).

- fate of the remaining billions old Kyoto-period CDM credits. My proposal would be to cancel 30%, bail-out 30% and transition 30% to the more ambitious Art 6.4. mechanism.

An agreement on these issues is held up in my view through the following positions some nations take:

- ‘Wait with decisions on Art 6.2. and 6..4 until there is more work done on ‘non market-based options‘ (Art 6.8). Why is that? Countries are free to choose any option they prefer. The use of carbon markets does not need to wait for coordination on alternative approaches

- ‘Apply share of proceeds (SOP) on Art 6.2′ .That demand does not make sense. It is fair to apply a fee on a credit mechanism like Art 6.4, as was the case with the CDM to collect funding for adaptation. But adding a fee to each ITMO transfer burdens the trade and is not needed as nations that make use or cross border trade and regional emissions trading systems (ETS) usually already donate to the Adaptation Fund with revenues of auctioning ETS allowances.

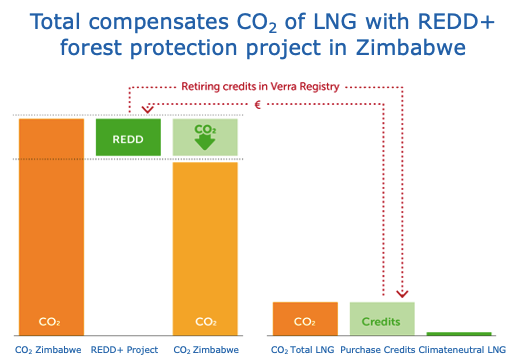

- ‘Wait for guidance on carbon trade until developing countries are transparent on thee implementation of the Paris Agreement and how they meet their targets’. Without any support it is hard for developing countries to report on all their emissions for the first time and to predict how and if they will meet their National Determined Contribution (NDC) target. Against this background to correspondingly adjust transferred mitigation outcomes (IMTOs) from their account is difficult. Only for more advanced developing countries like Peru, that is establishing an emissions budget to track progress and wants to operate an ITMO transfer registry this becomes possible. MarkIT is preparing a Meta-Registry for global carbon credits. For other countries the voluntary carbon market establishes already transparency of emissions and reductions that help meet their national target, So in my view, the voluntary carbon market (VCM) does not need to wait for UNFCCC decisions, as correspondingly adjustment is to avoid double counting amongst countries (see my earlier column on Ecosystem Marketplace on this).

Countries can already make use of transferred mitigation outcomes under Art 6.2. as long as they are transparent and apply double entry bookkeeping

More is expected outside the UN regime from a carbon club of countries that cooperate in making use of carbon markets to help meet CO2 targets or link their emissions trading systems. The EU Commission and US and Germany have indicated their interest in working with carbon clubs.

Voluntary carbon markets spur ambition and transparency

Also, the independent voluntary carbon market (VCM) can in the meantime help meet nations meet domestic CO2 targets: for example investing in a cook stoves project in Tanzania can help Tanzania meet its NDC target. By purchasing voluntary carbon credits, companies can compensate the impact of their remaining residual greenhouse gas emissions, in addition to reducing its own avoidable reductions. See ICROAs paper on the role of the VCM and why corresponding adjustment is not needed for VCM.