Member States should ask the Commission to propose an auction floor price.

To achieve the agreed EU CO2 targets for the emissions trading sector (11.000 sites), the level of the CO2 price does not seem to matter; it is based on demand and supply. However, because the EU has other goals, such as a rapid transition to a low carbon energy sector, predictable climate policy and CO2 prices and better air quality, there is reason to pursue a higher CO2 price than today. We can reach the CO2 targets, but current price trends risk a sudden peak price by 2030, because of the scarcity of allowances then.

The most practical way to achieve a higher CO2 price for this purpose, in my view is through a floor price for the auction of emission allowances. Auctioning applies to the power sector, around 50% of the ETS. The industry will still receive the allowances mainly for free, and it can sell against the market prices. If the auction bids remain below the floor price, the allowances will be kept in the Market Stability Reserve.

Stimulus

If we want greener power earlier and deal with other environmental issues (air quality) and a nice forward curve for the CO2 price more progressively, in addition to the quantity (maximum amount of allowances) also the price can partly be arranged. This can be done by setting a, as I would call it. “Predetermined Minimum Auction Reserve Price”’. A minimum CO2 price for the auction of, say, 20 euro per tonne from 2020, mainly affects the energy sector, which advocates precisely for higher prices. The industry will be largely allocated for free on the basis of energy efficiency and CO2 benchmarks. For the industry the CO2 market price is still valid.

There is an additional benefit: with an auction floor price, there is also an incentive for the industry to take additional CO2 measures and sell lucratively just below the auction price. Accordingly, also the surplus amongs industry decreases, cause more demand will come from power companies that seek to avoid the auction price, although the market price will be not much below the auction floor price. The impact on the carbon market remains to be seen and depends on the overall demand and supply. Earlier research indicate that an auction reserve floor price, hand in hand with quantity measures such as the planned Market Stability Reserve benefit the auction revenues. An auction floor price clearly helps meet the auction regulation objective:

Auction Regulation: Auctioning should support and strengthen such a carbon price signal.

Economic theories

According to the economic theory price ceilings and floors create inefficiencies, as buyers and sellers are not fully free to trade at a prices they wish. But another Nobel price winning economic theory describes carbon trading not as ‘leaving it to the market’. Hence, the carbon market is a compliance market and a mechanism design by government intervention. Governments may intervene to adjust the objectives and the stimuli. So, policymakers need to determine whether the benefits are worth this market inefficiency of a floor price, just for auctioning.

Secret reserve price

Under the Commission Regulation on the timing, administration and other aspects of auctioning – of around 1 billion allowances per year – an Auction Reserve Price is set (Article 7). This is done in secret for each auction in advance. If the maximum bid for emissions remains ‘well below’ the reserve price, the auction will be cancelled and the allowances are not auctioned, but distributed over upcoming auctions. EEX cancelled for example the auction of January 18, 2013. The reserve price will often be close to the previous market price, but no one knows exactly. There were doubts whether that was the case here.

California does it

The California cap and trade system, learning from the experiences in the EU, the low CO2 price and lack of a price signal, has a floor price for the allowanes, that are auctioned. The Annual Auction Reserve Price was initially set at 10 dollar per ton of CO2e, increasing annually at the rate of inflation plus five percent. For 2016 the floor price is 12.75 dollar. If that price is not bid, the allowances move to the next auction.

Growing interest in EU

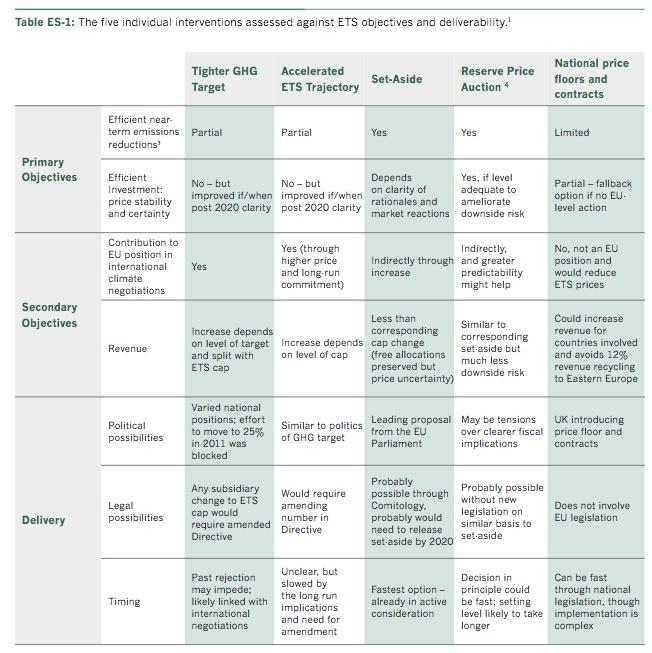

More and more voices are raised to do the same in the EU. The French government supports a price within a corridor for the ETS, and considers domestic measures. Though it is clear, that that would lead to a larger surplus and a weaker price signal! And The Netherlands Bank is calling for a hybrid model, with a minimum CO2 price, without specifying yet how to do that, to prevent abrupt risks and to promote a controlled transition. The Netherlands Environmental Planning Bureau mentions a predictable CO2 price path by means of an auction reserve price and important for the development of low-carbon technologies. The Shift Project think tank recommends a minimum auction price of 20 euro. German Agora Energiewende recommends a minimum auction price of 30 euro annually increased by 1 euro. Earlier Michael Grubb for Climate Strategies proposed a fairly modest starting and rising price for the European Reserve Price for Auctions (see the table at the bottom, comparing improvement options).

Simple rulemaking

A big advantage as I see is it that an auction floor price requires only an adaptation to the Commission Auctioning Regulation. The Commission can propose this, in consultation with Member States. An amendment of the Emissions Trading Directive is not necessary; it does not need to go to the European Parliament for approval. Moreover, having an annual floor price avoids having to establish a reserve price for each auction. Member states can agree a price, just as was done for the arrangements for carbon leakage and carbon cost compensation, for which a CO2 price of 30 euro was adopted; or one can pick the average price of 25 euro from 2021 to 2030 as was chosen in the impact assessment of the Commission on the 2030 energy and climate framework.

No taxation: no unanimity required

The European Commission is reluctant towards price mechanisms and would position itself against a minimum auction price, because it assumes an auction floor price is regarded to be a tax. In that case unanimity is required in the Council of Ministers.

However, in the literature this is rightly contested. It is not a tax, because the buyers get allowances transferred, the revenue does not go directly to the national treasury. Revenues are collected by the auctioneer and distributed to Member States according to a very specific distribution agreement. And because it is not a tax, it is no consensus needed in the EU for such a measure. As Michael Grubb puts it “requires amendment to the secondary legislation, via majority in the Climate Change Committee”.

So, I suggest The Netherlands, Germany, France together with other Member States to ask the European Commission to propose a Predetermined Minimum Auction Reserve Price, per 2020, to begin with 20 euro.