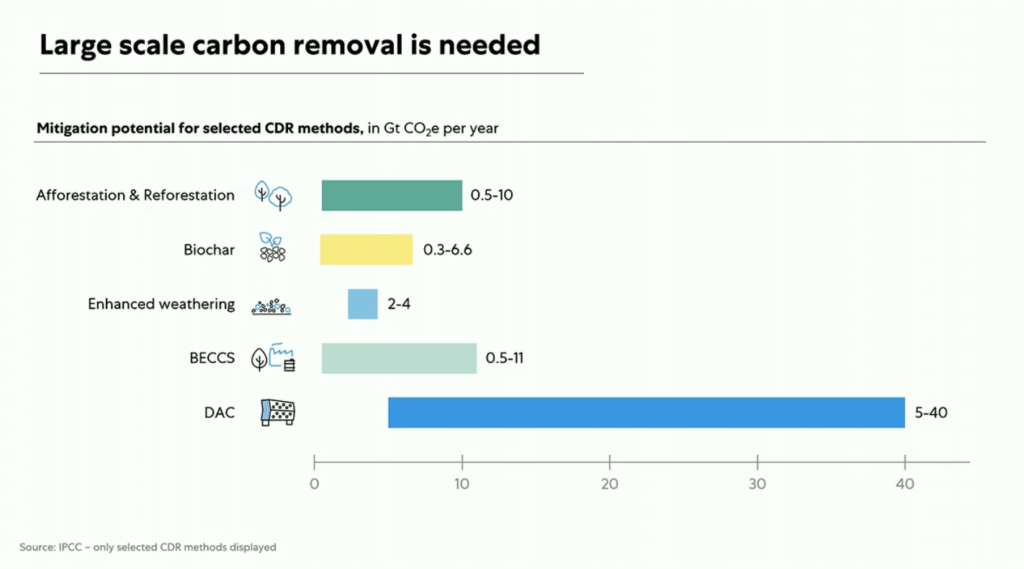

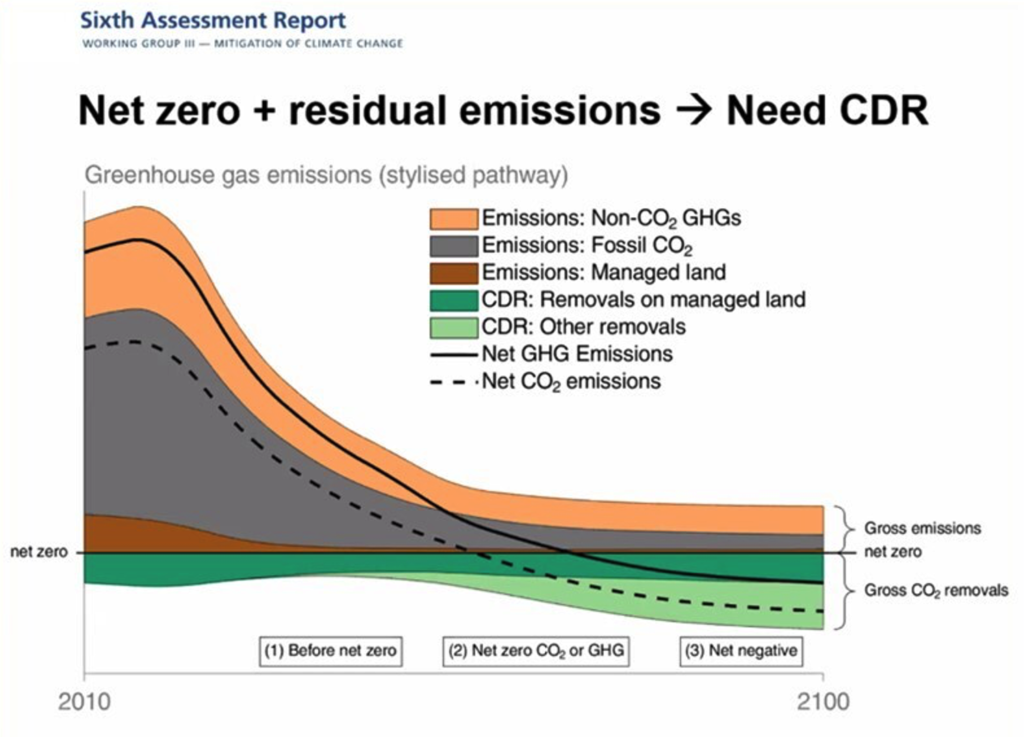

IPCC sees a need for CDR – nature-based AND direct air carbon capture and storage – of 7-9 Gt for the 1,5 Degrees target in 2050. The 2024 Emissions Gap Report writes that next NDCs “require a much faster progression through its formative phase to reach gigaton scale by mid-century“, mentioning 30-800 Mt of novel CO2 removal in 2035. The voluntary carbon market (VCM) plays an initial role for novel Carbon Dioxide Removal (CDR) demand and in the finance of storage of carbon dioxide, but will ultimately remain too small. Total CDR credits were in 2023 4% of the $ 1bln VCM, but growing quickly, writes Carbon Direct, mainly forest projects. And CDR was only 1% of these forest credits.

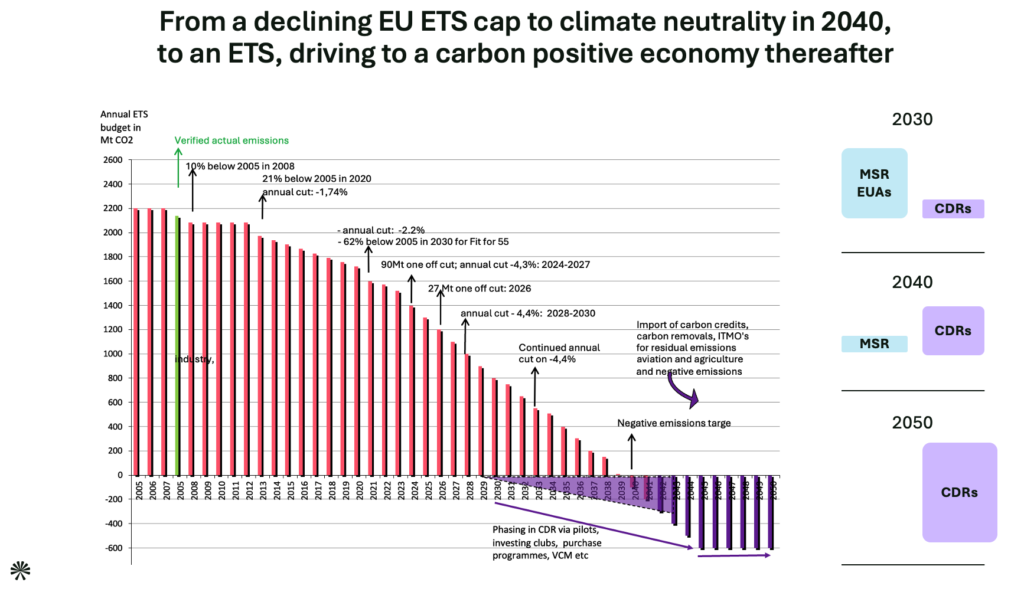

The mandatory, regulatory CO2 market, like the EU ETS, is indispensable to deliver the number of removals necessary. Importantly, after 2040 there are no more new CO2 Allowances available under the EU ETS. Carbon removals will be indispensable to cover residual emissions after 2040 (est. 400 Mton in 2050 in the EC Impact Assessment). Decarbonising some EU energy-intensive sectors by that time is still tough business, the ECB reported.

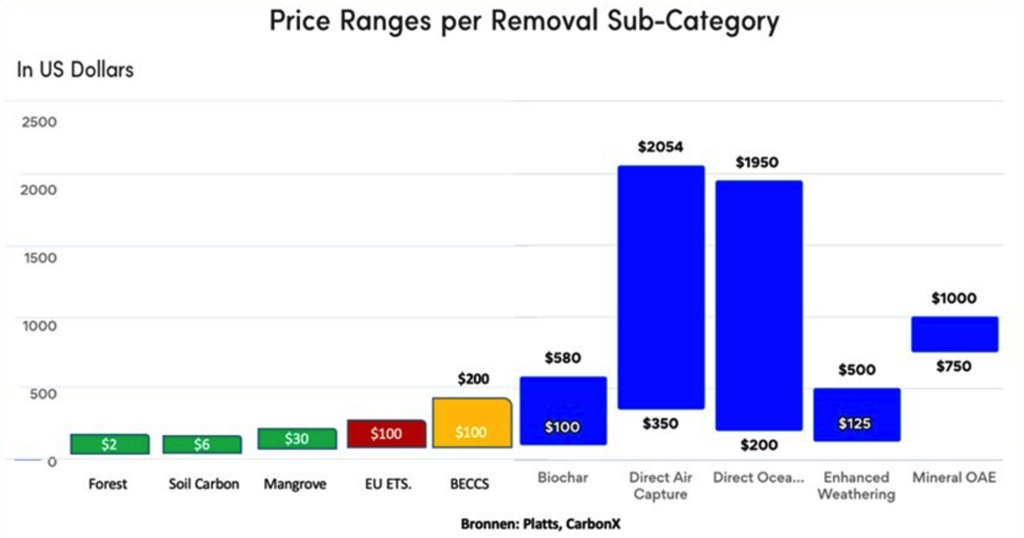

Will carbon removals be affordable? IEA estimates that costs for Direct Air Capture (DAC) could fall to €100-300/tCO2 by 2050, and BECCS to €50-200/tCO2. The EU Commission estimate future cost of BECCS at €55-134/ton CO2 and DAC at €122-539/tCO2, seen as more competitive with future abatement for hard-to-abate sectors. Therefore in the Competitiveness Compass the Commission pleads to develop incentives in the context of the ETS review in 2026, to build a business case for permanent carbon removals to compensate for residual emissions from hard to abate sectors. CDR platform Milkywire suggests DAC companies estimate future costs averaging $137/tCO2 at just a megaton scale; current median price is $530 per tonne.

I gave my input into the European Commission consultations on the ETS Review on July 12, 2025 here.

After 2050 the EU as a whole has a negative emissions target. So after 2040 the ETS needs to build up a negative emissions budget of Carbon Removals

1.Linking CDR to EU ETS

In brief, my approach to link CDR to the EU ETS is the following

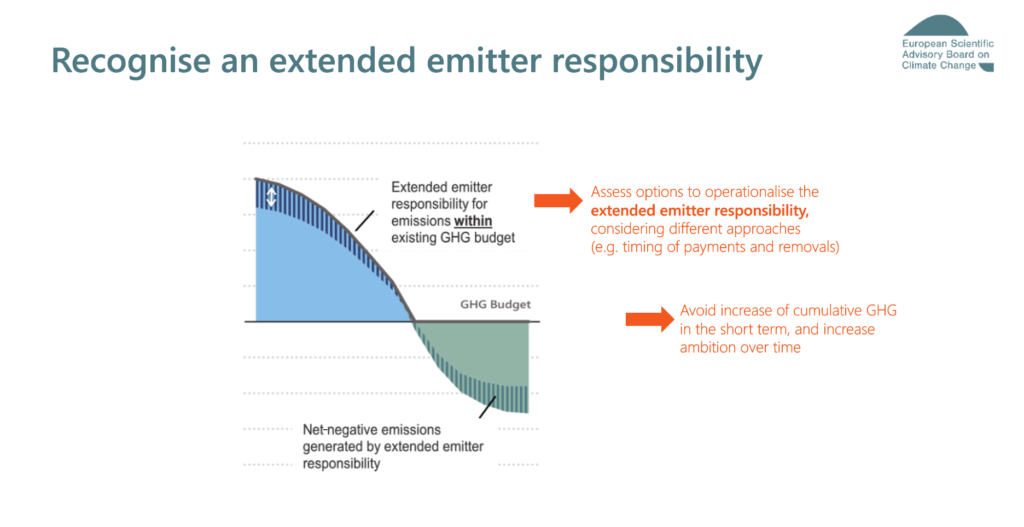

- Linking CDR to the EU ETS is needed, to help ETS meet its #negative emissions target after 2040. Overall, the EU has to be climate negative after 2050), this is also supported by the recent advise of the EU Scientific Advisory Board.

- Phase-in linkage of CDR to the ETS early is required to boost supply, help monitor quality and mobilize a large pool of high quality novel CDR credits. Deterrence of emissions will not play a role if linking is done smart (see below)

- Indirect linking, organised via an entity that executes an administrative assignment with transparent political EU oversight, can mobilize public and private funding, for example the existing European Investment Bank (EIB) that can already use ETS auction revenues.

- In the meantime, companies can of course already invest in CDR projects via the Voluntary Carbon Market or the EU Carbon Removal and Carbon Farming Certification Framework (CRCF) and CDR credits can then be purchased by the EIB accordingly.

- Linking CDR to ETS includes in particular permanent carbon removals (BECCS, DAC, Biochar, chemically bound CO2 in products); if less permanent carbon removals (buildings, soils and forests etc) get a robust ‘discount rate’ applied based on removal time (see BCG) they could also be used. The corporate disclosure regulations in the EU (CSRD/ESRS) require:“permanently removing an equivalent volume of CO2″; removing a volume is not the same as, use only permanent removals credits. Some propose that less permanent removals should offset less permanent greenhouse gas emissions like #methane. Indeed that lives 20 yr in the atmosphere, but the climate impact is 80 times stronger than carbon. So to add up you have to use more temporary removals. That is the same approach as using discounting for shorter lifetimes. The EU Scientific Advisory Board does not advise a link of less permanent removals to the ETS, but to give it a carbon price and apply a discount for their actual lifetime.

2.Other proposals regarding linking CDR to EU to date

Several organisations and researchers published their views on linking CDR to the EU ETS.

- Scientists of Potsdam and Grantham institutes describe the ‘End game’ of the EU ETS and suggest a fundamental change from positive permit auctions to multiple private sellers of negative emission certificates. Carbon removal credits as new source of supply that could be before 2040 be surrendered for compliance, de facto loosening the zero cap on positive emissions. They say it is however unclear how, when and to which extent negative emissions could be integrated in the ETS. They note though that to stabilize the supply and price a intermediary institution like a carbon central bank should play that role.

- The Kiel Institute c.s. advise that the EU agree a ‘net negative cap’ to create negative emissions demand in general and to introduce various EU supporting mechanisms for removals. And they suggest a new Carbon Central Bank to purchase CDRs.

- Perspectives cs suggest 2 ways of linking: accepting removal credits instead of allowances or allocating free allowances to installations achieving removals.

- Ecologic says future linking to carbon removal helps continue the acceptance of the ETS, but they prefer to limit the use of removals as much as possible or leave the purchase to an intermediary. They would only accept DAC and Enhanced Weathering, and not allow BECCS for example.

- CAKE calls for an EU Central Carbon Bank to take over ETS mechanisms like the Market Stability Reserve and to purchase additional CO2 budget for residual emissions and negative emissions after 2040 via Art 6, DAC and CDR.

- Mathias Fridahl c.s. propose to link CDR conditionally to the ETS or into the EU Land Use legislation and link the removal credits then to the non-ETS Effort Sharing targets.

- Rickels et all plead to convert CDRs into fungible credits and auction as ETS permits. They suggest a conditional integration of carbon removal under an active institutional mandate to keep control on volume, costs and price-caps.

- Recently ERCST researchers said the linkage of negative emissions, specifically CDR technologies like DACCS and BECCS are likely to be included in ETS1 by 2031, ‘with medium likelihood’, necessary for the long-term viability of emissions trading in the EU, especially as it approaches net-zero and potentially net-negative emissions. It could starting with issuing CDR units first an then link them later.

- BPs low carbon strategy VP Jeff Swartz also supports linking CDRs to the ETS, technical as well as nature-based

- For the FORES policy paper on CDR Kenneth Möllersten and Lars Zetterberg write they prefer to start with State Support for CDR to gain experience. Linking as quota for hard-to abate sectors and ETS is needed to broaden the financing basis and increase volumes, with a control mechanism to avoid an overuse of carbon removals

- Concito and CATF (The Balancing Act) advocate in their December 2024 report linking CDR to ETS, avoid incentivizing only the cheapest, take measures to prevent deterrence of abatement and avoid sustainability risks with BioCCS.

- Sandbag finds (Dec 2024) that methods of CDR still need to mature and that there is no need to link CDRs to the EU ETS before 2040, as there is still an allowances surplus in their view and that public funding can a better support of CDR;

- ICAP (March 2025) identified several ways governments can develop ETSs and the role linkage of CDR credits can play, depending on the target of the ETS.

3. My view how to link Carbon Dioxide Removals to the EU ETS

Negative EU ETS cap is key for CDR demand

The EU ETS Directive should in my view indeed be amended to lead to a negative emissions target after 2040 (see figure below) as contributing to EU’s long term negative emissions target. Whereas the declining ETS cap leads to climate neutrality in 2040, it should now lead to a climate positive impacts by participants. In October I presented my proposals in the GHG Trading Workshop by IEA-IETA-EPRI. I highlighted how the EU ETS can get a #negative emissions target, gradually introducing carbon #removals from EU and global projects. Stephanie La Hoz Theuer of ICAP presented ways governments can adapt ETS designs for a net-negative future. Christina Hood presented New Zealand’s plans to link ETS with forest carbon removals. The EU Scientific Advisory Board also foresees a negative emissions target for the EU ETS and sees the need for companies to surrender removals to help meet the negative target as ‘extended emitter responsibility’ (see figure below). Hence, The EU ETS has been proven to be an effective policy instrument to comply with targets and to limit and distribute cost. It needs to be elaborated now how to set and allocate a negative cap.

That can be done for example by the obligation to purchase and/or surrender allowances of:

- x ton negative emissions/kWh energy, Joules heat/cooling used, or

- y ton negative emissions/ton bio-based or recycled carbon used.

Hence, in that case, also the use of green power, green hydrogen and green carbon leads to an obligation to surrender negative emissions as license to operate. In my view, the ETS started as system to bring fossil-based emissions from ETS participants to zero in 2040; until 2040 also linking to other ETS and making use of the global carbon market (Art 6.2. ITMOs) helps meet zero. After 2040, it can become an economy-wide system to distribute new the overall net negative emissions target amongst all participating companies.

The scope and amount of future negative ETS participants could cover:

- Current ETS-1 participants, until and after they are at zero: 10.000

- New ETS-2 participants until and after they are at zero: 10.000

- New ETS-3 (ETSAg) participants (midstream/upstream) until and after they are at zero: +/- 10.000

- Participants that were never under ETS-1 or ETS-2, that are major users of green, biobased power, heat or hydrogen of users of recycled carbon (CCUSE/BECCUS/BiCR_USE).

The future is a carbon positive economy!

Six ways to link CDR to the EU ETS

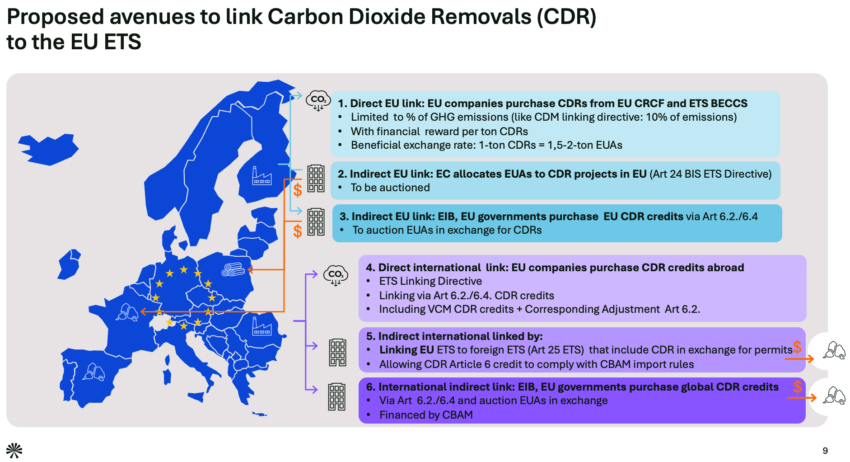

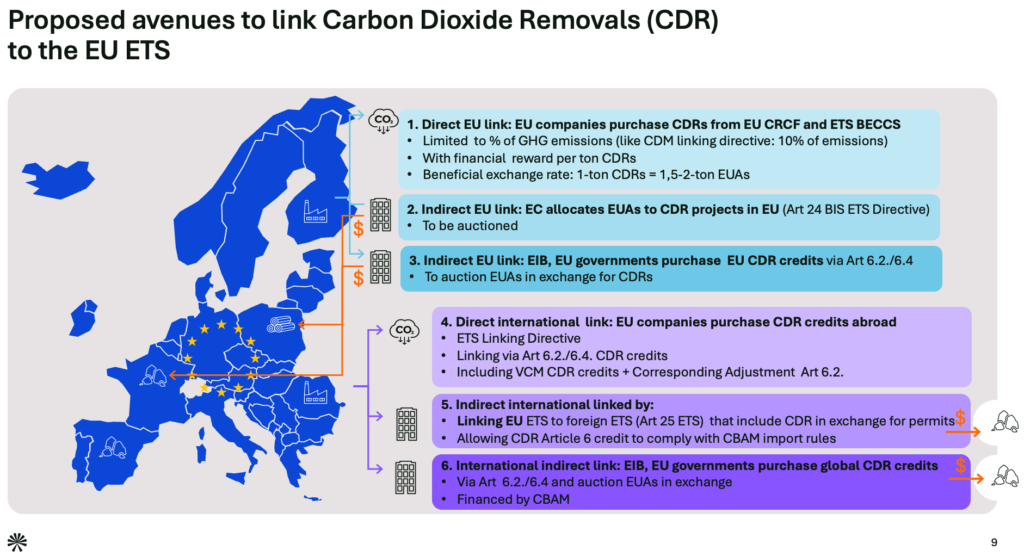

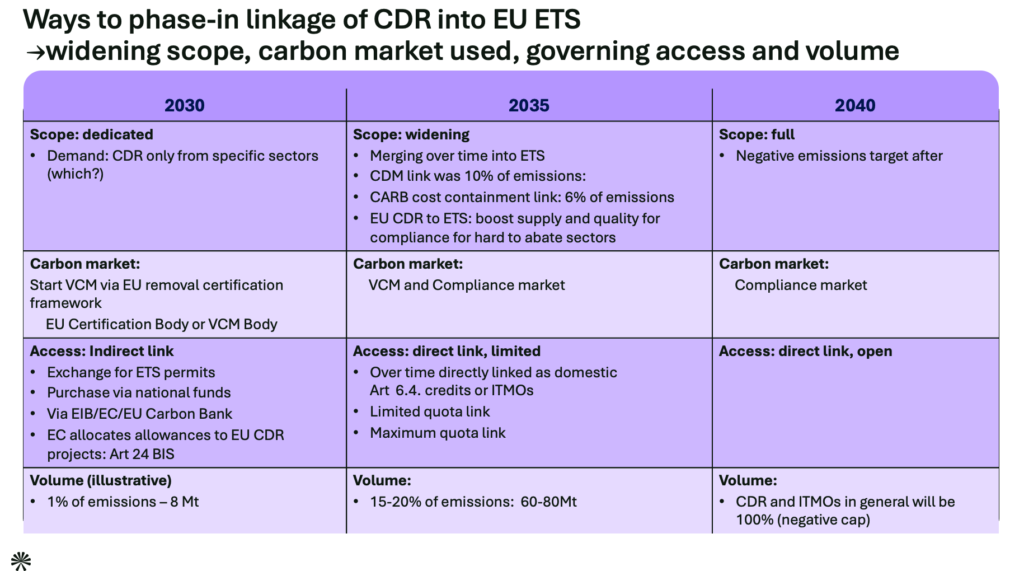

For linking CDR credits specifically to the EU ETS there are 6 ways by which carbon removals can be directly, or indirectly, linked to the EU ETS (See figure above):

- Direct EU link: EU companies purchase CDR credits from EU CRCF projects, whereby ETS participants buy carbon credits on the market, and can exchange them for EU emission allowances. This van be accompanied by provisions to stimulate supply of CDR, while controlling supply and quality and and prevent eventual deterrence of emissions reductions:

- A limited link, phasing in the import of CDR. Now that the ETS will no longer auction new emission allowances after 2039, CDR is still in its infancy, and the costs of CDR are very high, it is wise to have a limited link after 2030 – for example for 1% of the emissions – 8 Mton. By 2035 that percentage can increase to 25% for example 100 Mton by then. In 2040 import of CDRs and ITMOs will be 100%.

- Provide an extra reward, for example that a ton carbon removed can be exchanged with 1.5-2 ton EU Allowances provided the storage is permanent in order to generate negative emissions

- To reward removals extra, from 2040 ETS participants may also be obliged to surrender 1.5-2 tonnes of emission allowances or carbon removals for each tonne of remaining emissions

- Indirect EU link: The EU can also decide to allocate free emission allowances to EU CDR installations or removal projects; these can then sell these EUAs. As model the inactive Art 24 BIS ETS could work: issuing permits to projects that reduce or remove CO2 emissions. This is an option the European Commission is currently looking info

- Indirect EU link. The purchase of international CDR credits can also be done by the European Commission, via the EIB or by Member States to build up a negative CO2 emissions budget into the MSR for after 2040 and for residual emissions. Thereafter, they can exchange CDR credits for emission allowances. For example, the Netherlands Scientific Climate Council recommends launching a Dutch government-led CDR procurement programme.

- Direct international link: EU companies purchase CDR credits directly from projects outside EU. In order to ensure these credits can be used for compliance under the EU ETS the following paths can be used:

- The ETS Linking Directive, whereby credits need to meet certain eligibility and quality requirements and these can then be exchanged by the EC into EUAs;

- Using Art 6.2. an 6.4. whereby the Art 6.4 Supervisory Body issues certificates for CDR and Art 6.2. ensures avoiding double when the credits are transferred to the buying company;

- Also possible is that CDR credits are issued on the voluntary carbon market and are then via the host country authorities “Correspondingly Adjusted”, according to Art 6.2. to avoid double counting when the credits are transferred to the buying company. Interesting is also to keep an eye on the developments in the UK, that started consultations to link CDR to the UK ETS.

- Indirect international link by:

- linking the EU ETS to foreign ETS (via Art 25 ETS Directive) that can include CDRs in exchange for permits. By purchasing allowances from other ETS systems that partly indirectly stimulates CDR in those jurisdictions. Currently the EU only linked their ETS to that of Switzerland.

- CBAM as driver of removals: Allowing exporters into the EU falling under the Carbon Border Adjustment Mechanism (CBAM) to surrender domestic removal, if under a regulatory system (see) or as Paris Agreement Art 6 carbon removals credits as part of their obligation to compensate remaining embedded emissions of the imported products: the credits will then be transferred to the EU and taken out the host country registry to avoid double counting (so-called ‘corresponding adjustment’)

- Indirect international link whereby EIB or EU governments purchase international CDR credits that are transferred via Art 6.2./6.4 that also avoids double counting, and auction EUAs in exchange for those credits. They might do that to build up a negative CO2 emissions budget into the MSR.

Risk of mitigation deterrence can be avoided

Criticism is often heard that early attention and investment in CDR leads to deterrence of necessary mitigation. This is raising concerns of “moral hazard” or “mitigation deterrence” (the MH/MD debate). A stakeholder research by Apergi c.s. on CDR application in Germany indicates ‘approval’ for early incentives for CDR depends on trust in long term climate policy, limits it to residual emissions. This is discussed in a recent paper of WRI, International Governance of Technological Carbon Removal: Surfacing Questions, Exploring Solutions. There is scientific consensus that meeting global climate goals requires both deep emissions reduction and carbon removal. Concerns that CDR might result in mitigation deterrence are addressed in the integrated assessment models (IAMs) analysed by the IPCC because these top-down models optimize based on cost and assume rates of technology cost decline that may not happen. However, Carton et al. 2023 find that there is disagreement in the literature whether there is a risk. They argue that it is overstated and evidence is lacking, the CDR volumes are low. Excessive investment in carbon removal is not yet a concern, since technological carbon removal approaches make up less than 1% of carbon project happening today. They suggest to study more and gather evidence for either position and cannot be concluded there is a risk of deterrence. And as I showed above, there are ample manage tools to prevent deterrence.

CDR potential, like in subterranean basalt in the East African Rift combined with gigawatts of untapped renewable energy offer huge revenue opportunities.

In the meantime eventual mitigation deterrence can be avoided by:

- Ensuring that a country’s national climate plan does not rely excessively on carbon removal at the expense of emissions reductions;

- Limit the CDR link to the EU ETS to a certain % amount of CDR credits to avoid over reliance in the beginning (just like the earlier CDM credits could only cover 10% of companies’ ETS emissions);

- Some argue that CDR should be applied in countries with high current or historical emission and and not in developing countries, least responsible for the climate crisis, risking CDR would bring disproportionate negative impacts and insufficient local benefits. Those are incorrect arguments. The VCM can, besides in CDR still invest in other types of carbon projects, like avoidance of emissions in the South, that also bring social and natural co-benefits.

On the other hand, the CDR potential, like in subterranean basalt in the East African Rift combined with gigawatts of untapped renewable energy offer huge revenue opportunities. At a recent webinar by WRI, James Mwangi, CEO of Africa Climate Ventures criticized the protectionist approach by the EU allowing only the EU CRCF removals. Switzerland, and Scandinavian European countries are more open to buying international removal credits.

Moreover, CDR projects can go hand in hand with a positive impact on nature. In Kenya Climeworks and Great Carbon Valley are developing DAC with green industry development.

Next steps for the EU

With these above 6 options it is possible to create negative emissions and room for residual emissions with removals for residual emissions from the EU ETS (see purple shaded area in the figure after 2040). Although CDR is not yet explicitly included in the EU ETS, the ETS already covers CCS, CO2 transport via pipelines and geological storage relevant for removals. In addition, the proceeds from emission allowance auctions are reallocated via the Innovation Fund, including 4.6 Mton CO2 via CCS. Through the Net Zero Industry Act, the EU wants to stimulate 50Mt annual carbon storage in 2030. The US also stimulates $ 369 billion through the Inflation Reduction Act $ 180 per ton removal of DAC installations.

The European Commission could include the above options in the adjustments to the ETS in 2026 and report on how negative emissions can be accounted for and covered by emissions trading. And if the waste incineration plants fall under the ETS from 2028, there will be a link with the BECCS available there for the 50% biogenic CO2.

EU 2040 target

As the Removal Basel event showed, the EC is open to the EU target for 2040 for the import of DAC via Art 6 transfers. That may contain an ETS link. The EC has started consultations on the EU CO2 target for 2040 and whether international carbon credits can be used. The EC also needs insight into the required CDR for 2040. The EU has agreed in the Climate Act to be CO2 negative after 2050. It may appear from the consultations on 2040 that the EU must already be climate neutral by 2040 – scientists are calling for this – which brings forward the obligation of negative emissions.

5. Background on CDR and role of the carbon market.

IPCC definition of Carbon Dioxide Removal (CDR): ”Anthropogenic activities removing carbon dioxide (CO2) from the atmosphere and durably storing it in geological, terrestrial, or ocean reservoirs, or in products. It includes existing and potential anthropogenic enhancement of biological or geochemical CO2 sinks and direct air carbon dioxide capture and storage (DACCS), but excludes natural CO2 uptake not directly caused by human activities“.

And the IPCC finds CDR “an essential and unavoidable tool to achieve net-zero greenhouse gas (GHG) emissions”According to the IPCC, removing carbon dioxide from the atmosphere (CDR), is needed:

- firstly to keep global CO2 emissions negative after 2050. Because in developing countries the emissions will not yet be at zero

- secondly,residual emissions after 2040 are still difficult to reduce. In the EU, this concerns 5-20% residual emissions from agriculture, aviation, shipping and industrial processes

- thirdly, if the average temperature on Earth exceeds 1.5 Degrees C – the so-called ‘overshoot’ -, then the temperature will have to be reduced with extra carbon removals. The UN Overshoot Commission recommended in September 2023 the use of carbon removals; it was more cautious on ‘geoenineering’ (reduce solar radiation impact) and demanded more small scale research, especially in the South.

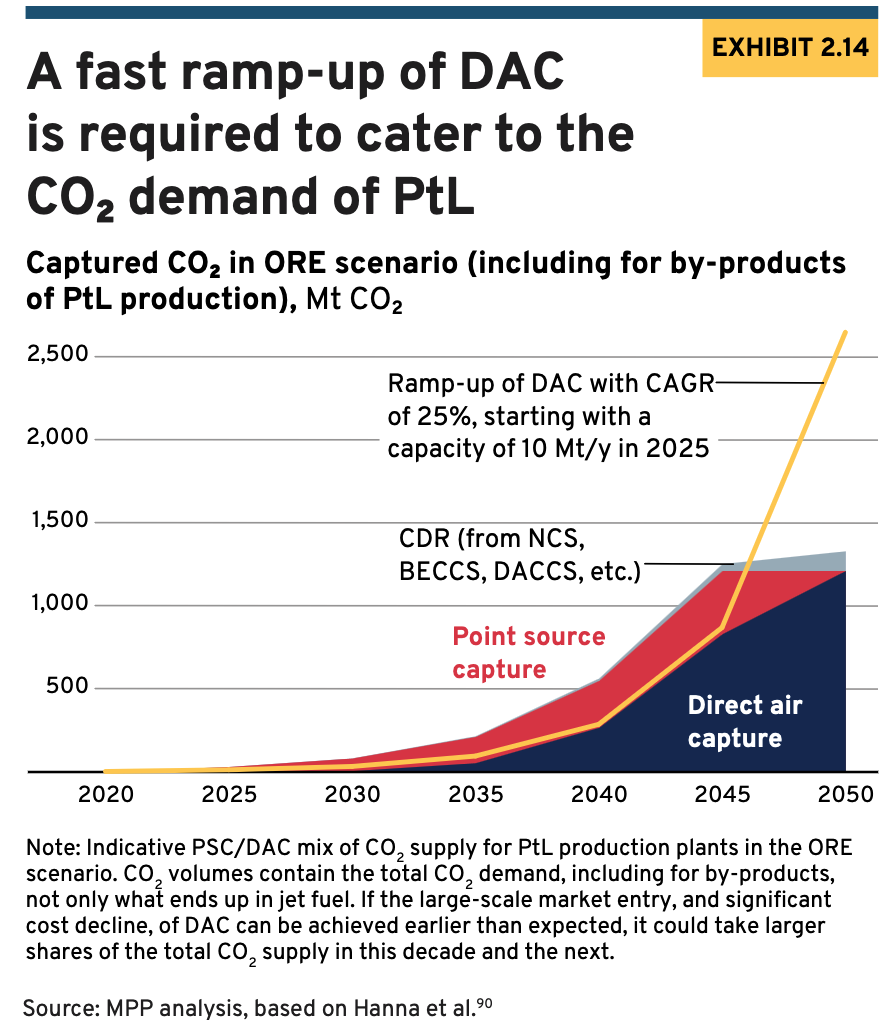

Removals are also indispensable for net zero aviation. In Destination 2050, the European aviation industry is expected to have 8% hard to abate emissions and to invest in carbon removals. And the Mission Possible Partnership expects global aviation to become one of the largest consumers of DAC: up to 490–730 Mt/y by 2050 for jet fuel emissions only. Including all product outputs of Power to Liquids plants even 800–1,200 Mt.

During the ICAO Assembly 2022, countries adopted a global net-zero target for aviation in 2050. In the Resolution, the North is invited to achieve ‘net-minus emissions’ even earlier than 2050, in order to create emission space for the South. This implicitly asks for removals. ANA was the first airline to purchase DAC credits. IAG (British Airways) plans to buy 2 million CDR annually from 2030 and 100 million in 2050. Robert Hogland of CDR.fy goes even further saying:” Removals are better and cheaper than reductions for aviation like with e-fuels.”. And at the DAC Summit in 2023, Rich Lesser, of Boston Consultig Group said:”Why do we as BCG invest in DAC? 78% of our emissions is aviation. We offset via nature based offsets, but we prefer to invest to complement in DAC, because that can tackle all emissions, while investing in SAF can only offset a few % global emissions”.

6. Progress, against background of divided views amongst experts on CDR

There is much progress in developing instruments to facilitate and finance carbon removals. The Supervisory Body of Art 6.4. recommends methodologies to generate carbon credits (6.4ERs) for countries to use CDR to meet their NDCs and allow cross-border transfers. It also adopted ways to monitor and remediation of reversals; the European Commission is elaborating the agreed carbon removal certification framework (CRCF).

But the progress is accompanied with controversy too. Some warn that attention for CDR is a distraction from mitigation and deters action; others say CDR does not have to be big; again others doubt whether CDR will be big enough to make impact. See article in Nature on ‘Controversies in CDR’.

7. Limiting warming to 1.5°C translates globally to about 4 Gton per year in 2030 and 10 Gton CO2 of CDR per year by 2050. Currently only 2 Gton is stored cumulatively, the majority of which in forests and soils, and only 0.002 Gton of technical removals, or Direct Air Capture (DAC). See “State of Carbon Dioxide Removal 2023”. According to the IEA, DAC installations must be able to absorb 85 Mton CO2 by 2030. By 2050, this should be 980 Mton per year. The current 18 DACs in Canada, Europe and the United States now capture 0.01 Mton of CO2.

8. How can we stimulate CDR supply in a timely manner?

Some organizations in the EU want this to be done only with policy and subsidy, as was shown at CarbonGap’s Carbon Removal Basel event last month. This concerns risks regarding permanence and social aspects and political preferences. Carbon Gap keeps track of what policy there is in Europe that wants to promote carbon removals. The European Commission is neutral about this, and only wants removals to be certified as reliable. They are working on this in the Carbon Removal Certification Framework system. At the Zero Emission Platform event last month, participants said that believe that the voluntary CO2 market initially plays a role in the current request for removals, but will remain too small to meet the demand. Ultimately, the mandatory CO2 market will be indispensable in this respect. This column is about possible market mechanisms.

9. Carbon Removals in the Voluntary CO2 Market (VCM) and initiatives

In 2021, almost 1 Gton of carbon credits was traded, half of which were nature-based. In 2020, this was 328,000, three-quarters of which are nature-based (cookstoves, wind, sun, biogas, forest, forest protection, etc.). As far as DAC removals are concerned, 800,000 in futures have been purchased, but only 80,000 removals have been realised and transferred.

Under their methodologies the Verra and PURO carbon credit programs – endorsed by ICROA as robust and high quality programmes – can issue carbon credits for the carbon stored with biochar. Currently there are 30 biochar credit suppliers under Puro. There are no projects listed yet under Verra. Puro also has methods for carbon storage in building materials. In addition, there are many carbon programs that provide credits for nature-based removals.

The voluntary carbon market demand is expected to increase to 3.5 GtCO2e by 2050. The voluntary CO2 market will not be able to generate 10 Gigatons of removals per year alone by 2050 (more details in last years’ Energeia Carbon Podcast; in Dutch).

10. Art 6 of the Paris Agreement

Countries can use Art. 6.2 of the Paris Agreement to purchase removal credits from other countries to contribute to their NDC target. Switzerland wants to buy 5 Mton of DAC abroad. Countries can for example then use these so-called ‘internationally transferred mitigation outcomes’ (ITMOs) to exchange for ETS allowances for companies in their regional scheme. Those ITMOs can be created by using carbon credits from voluntary market programs, like Verra and Gold Standard, or from the newly to be set up UN carbon credit mechanism of Article 6.4. of the Paris Agreement. But there are still a lot of discussions and conflicting views amongst countries and observers of the eligibility of carbon removals for Art 6.4. and on the pros and cons of natural and technological carbon removals (see UNFCCC Note for upcoming talks).

11. Private CDR Initiatives

In addition to the carbon credit programs, there are all kinds of private initiatives to bind buyers to expensive carbon removal and DAC investments. For example

- Frontier’s $1 billion Carbon Removal Buyers’ Club: Stripe, Alphabet, Shopify, Meta, McKinsey, H&M, JPMorganNextGen

- CDR Facility with South Pole: Mitsubishi, Boston Consulting Group, Mitsui OSK Lines, Swiss Re , UBS. They want to generate 1 Mton of carbon credits in 2025.

- JPMorgan is buying 800.000 ton of removals: 25.000 over 9 years from Climeworks (DAC) and 28.500 from bio-oil removals firm Charm over 5 years (bio-oil removals) and 450.000 tonnes via a 15-yr deal from CO280 (BECCS)

- Microsoft is spending $1 trillion to be carbon negative by 2030 and made a recent deal with Ørsted for 4,7Mton carbon credits over 11 years generated from their BECCS project

- Apple has a deal with Climeworks for 10Mt CDR in 2030 at $1,000/ton

- Klarna invests $ 5 mln in various international carbon removal companies via its Climate Transformation Fund arranged by Milkywire

- Amazon purchased 250,000 tons DAC credits over 10 years from the future 1PointFive DAC plant in Texas, developed by oil subsidiary Occidental’s Oxy Low Carbon Ventures.

11. What types of Carbon Dioxide Removal are there?

Natural removals

That is forest planting, forest management with CO₂ sequestration, mangrove restoration, peat meadow growth, regenerative agriculture with carbon sequestration in the soil, also known as (carbon farming) by returning organic residues to the soil.

This natural removal has additional advantages: soil improvement, biodiversity, water is better retained and it offers a healthy living environment. The disadvantage is that the captured carbon is not always permanent; usually 100 years is used. This is possible, for example, if a farmer chooses a different working method after a few years, or if newly planted forests are felled by a disease or fire, or if mangroves are damaged by sea level rise. Therefore, natural methods are rated as less permanent. Although that uncertainty can be corrected (for example by applying a discount of 10%) or by maintaining credit buffers.

Technical removals

These are so-called technological measures to capture CO2 from the atmosphere, however IPCC refers to ‘anthropogenic sink enhancement’ where the CO2 must come from the atmosphere via biomass or ambient air, so:

- BECCS: that is capturing the CO₂ emitted from co-firing of bioebergy or biogene waste incineration and storing it permanently in the soil

- DACCS: direct air carbon capture and storage. In that case, the CO₂ is filtered from the atmosphere with large vacuum cleaners or sponges or membranes and permanently stored as minerals like basalt

- Biochar: Another option is biochar, which is the charcoal as a residue of pyrolysis (sustainable energy generation with organic material) that is permanently stored in the soil

- Enhanced Weathering or accelerated weathering of minerals such as olivine by contact with CO2

- Ocean Carbon Removal. Removing carbon from the ocean to create additional uptake. This can be done biologically (photosynthesis with seaweed for example) or chemically (add alkaline compounds to water to raise the pH and counteract acidification through CO2 absorption). Both ways help increase the absorption of extra carbon dioxide by oceans.